When it comes to investing, one size does not fit all. Everyone has their own financial aspirations, risk tolerance, and timeframe they hope to achieve it in.

Glacier understands this and offers investments that cater to individual needs. Whether you're looking to preserve capital, generate income, or pursue capital growth, Glacier offers a wide range of collective investment funds to choose from.

This means world-class investment solutions and investment plans for each stage of your life, bringing together leading financial experts and respected financial services companies all in one place.

Glacier is an example of an investment platform that offers you a range of investment options in one place – saving you time and helping you make informed financial decisions.

By Tatum Whiting

If you’re ready to take your investment journey to greater heights, Glacier by Sanlam offers you a “one-stop-shop” for your future investments – helping you broaden your horizons and simplify the daunting process. But what does that "one-stop-shop" concept really mean?

An investment platform such as Glacier simplifies the investment process for individuals by serving as a convenient hub with a wide range of local and international funds from different fund managers, all in one place. The platform conducts due diligence checks on the funds before making them available for investment, and they ensure compliance, risk management, and reporting procedures are in place to provide investors with efficiency and confidence.

It's important to note that investment platforms act as custodians of the assets but do not directly manage investors' money. The asset managers remain responsible for the investment performance of the funds, and the overall performance of an investment vehicle depends on the underlying funds included.

Together with your financial adviser, you can use an investment platform to combine and invest in various solutions to create a diversified investment portfolio – which makes investing easier and removes a lot of the admin involved in the process. Glacier also provides information and online tools to help free up more of your time.

Wondering if it’s the best option for you?

Here are the benefits of using Glacier’s investment platform:

- You can mix and match funds to suit your individual needs.

- Enjoy 24/7 online accessibility for your convenience.

- Save time and admin – all your investments are found on one platform.

- Individualised admin provides statements, tax certificates & accounting services.

- The platform acts as a “middleman” between an investor, a financial adviser and an asset manager.

Ask your financial adviser why you’re not with Glacier by Sanlam!

Wondering if you still need an asset manager if you’re using an investment platform? We break it down for you.

An investment platform and an asset manager are two separate entities in the financial industry. The investment platform serves as a “middleman” between an investor, a financial adviser (someone who helps the investor make decisions), and an asset manager (the company that manages the investment funds).

Think of the investment platform as a central hub that brings all these parties together, providing a user-friendly interface to manage and monitor investments in different funds. It’s a convenient service that holds various investment options – like retirement annuities or endowment funds – all in one place. It holds investment funds and vehicles, allowing financial advisers to create customised portfolios for their clients by combining funds from different asset managers.

The platform provides access to a wide range of asset managers and investment options, making it convenient for investors to find the funds they want without having to approach multiple asset managers individually.

Glacier Research has shown the more choice you have, the better the risk-adjusted returns should be over time.

An asset manager is responsible for managing the actual investments within the funds. They develop and implement investment strategies aligned with their risk-and-return objectives. The asset manager's expertise is expected to enhance performance compared to the overall market, but they cannot entirely remove the impact of the underlying asset class or broader market conditions. People often believe that an investment platform is linked to an asset manager, but that's not the case.

The Glacier investment platform, for instance, doesn’t manage the money even if you, or your adviser, choose your asset managers through it. It’s the asset managers that are responsible for the performance and the underlying asset class. A platform is not responsible for an asset manager’s performance. What the investment platform does do, is to conduct due diligence on the asset managers on its platform to ensure they meet certain standards.

Ask your financial adviser why you’re

not with Glacier – today!

When you invest money you want to see results – here’s how to assess the performance of your investments.

Investing your hard-earned money may seem daunting, but it’s a smart step towards building wealth and achieving your financial goals. If you’ve been saving to meet your short-term goals and you’re ready to invest like a pro, let’s get you started!

Important factors to consider when investing:

- Your goals will shape your investment strategy – whether you’re saving for retirement, buying a home, or funding your children's education.

- Decide what is your “risk tolerance” – longer timeframes generally allow for higher-risk investments, while shorter time horizons may involve more conservative choices.

- Assess your comfort level with potential fluctuations in the market.

- Research your investment options to diversify your portfolio and spread the risk.

- Stay informed about the market conditions, economic trends, and industry insights that may impact your investments.

Once you've made your investments, it's crucial to monitor their performance to ensure you're on track. Glacier by Sanlam allows you to make the most of your investment opportunities and pivot accordingly.

If you want to evaluate the success of your investments – and know if you’re on the right path, it’s important to understand certain key indicators. It can be tremendously helpful to seek help from financial professionals to help you on your investment journey.

The Glacier Research team provides guidance on how to understand your investment's annual performance – and how to make smart investment decisions. Here’s how to gauge your investments’ annual performance.

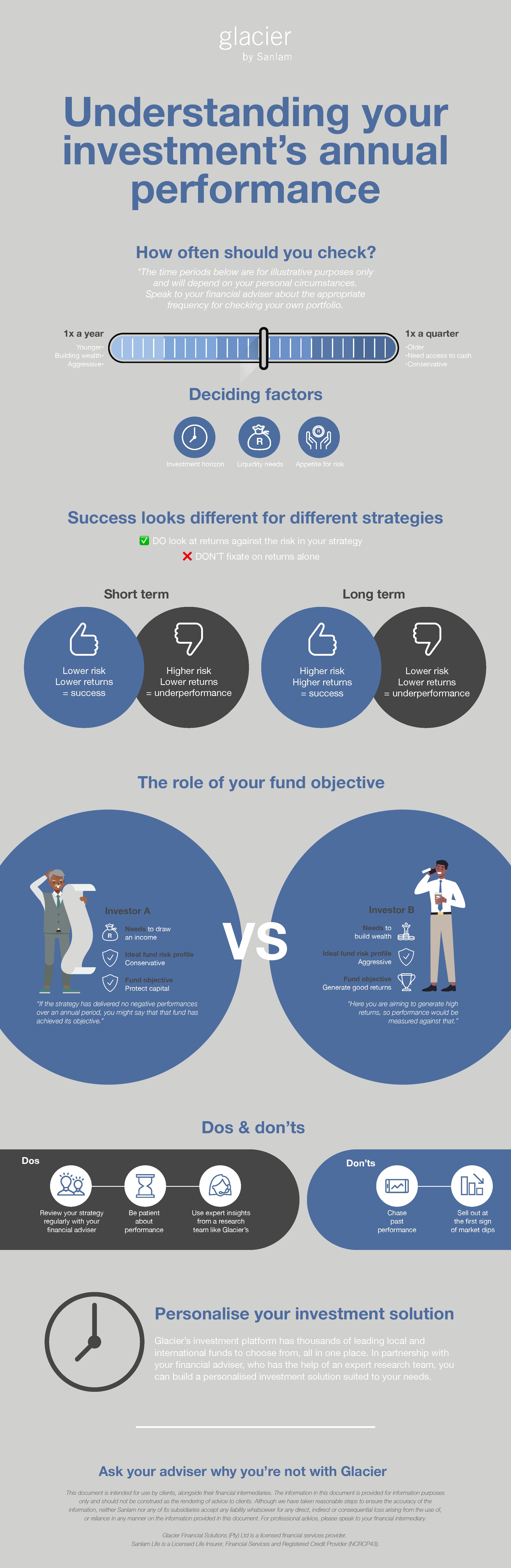

How often should you check?

How often you check your investments’ performance depends on factors like risk appetite, investment horizon, and liquidity needs. For shorter-term objectives, checking once a quarter is reasonable, while for longer-term investments, checking annually is sufficient.

Don't only focus on returns

While the annual performance graph of your progress provides an overview of returns, it's essential to consider the risk associated with your investment strategy. High returns may come with high volatility, while low returns come with less unpredictability. Assessing returns in the broader context of risk is important.

Consider your fund objective

Your fund objective should align with your investment goals. For conservative strategies focused on capital preservation, performance is measured based on the ability to protect value. For aggressive strategies targeting higher returns, performance is evaluated relative to specific benchmarks.

Avoid chasing performance

Chasing past performance is a common mistake. Short-term underperformance doesn't necessarily require switching funds. Investment strategies operate in different economic environments, and trends change over time. Patience and trust in fund managers are crucial for long-term success.

Partner with experts

Consulting with an adviser and leveraging their expertise adds value to your investment strategy. Advisers have access to specialised research teams and resources, providing insights and customised investment solutions.

Glacier's investment platform offers a wide range of investment opportunities for your personalisation.

Starting the journey early is your best investment opportunity – here are some of your options.

The key tenets of investing

- Invest early

- Invest regularly

- Invest as much as you can

- Create a plan

- Diversify your portfolio

Sibabalwe Mgijima, Business Development Manager at Glacier by Sanlam states, “I highly recommend starting to get into the habit of investing, even with as little as you can, from as early as you can – ideally as soon as you get that first salary.” Investing as early as possible can be advantageous for maximising returns, thanks to the power of compounding. “Compounding” refers to the process by which the returns earned on an investment are reinvested, which generates additional earnings over time.

When it comes to investment opportunities in your 20s and 30s, experts recommend the following strategies:

Build your emergency fund

Start by setting aside money for emergencies. Consider investing in a unit trust fund, which offers flexibility and the potential for growth. Choose a portfolio that aligns with your risk tolerance.

Start a Retirement Annuity (RA)

If you're not a retirement fund member or want additional retirement savings, an RA (retirement annuity) is a good option. With a minimum retirement age of 55, you have a long investment time horizon, allowing for potential growth. Consider a more aggressive portfolio for better long-term returns.

Take advantage of tax efficiency

Use approved retirement savings funds for tax deductions on your contributions. Additionally, consider opening a tax-free savings account, such as the Glacier Tax-Free Investment Plan, which offers customisation and tax-free growth on capital gains and interest.

Partner with a financial adviser

A financial adviser can help you develop a well-thought-out portfolio tailored to your needs. Their expertise can maximise your returns and ensure you make informed investment decisions.

AVOID THESE COMMON MISTAKES

Relying solely on a savings account

- A regular savings account may not provide substantial growth. Explore investment options with higher potential returns.

Stagnant contribution amounts

- As your income increases, adjust your investment contributions accordingly. Increase your savings to maintain the purchasing power of your money over time.

- Consider using a one-stop investment platform like Glacier's, which offers a wide range of investment funds and options. It provides flexibility, customisation, and the ability to adapt your portfolio as your goals and needs change throughout your life stages.

- Remember, it's essential to consult with a financial adviser to assess your individual circumstances and develop a comprehensive investment plan that aligns with your goals and risk tolerance.

Consult a financial adviser to assist you on your investment journey.

Wondering if it’s too late? When you’re considering investing, earlier is best, but now is better than never when it comes to tackling your personal finance – here are some tips.

When you approach your 40s or 50s, it comes with a considerable mindset shift regarding your future, with finances at the forefront. You may be dealing with debt, medical expenses, your children’s education expenses, bond repayments and home renovations – all while mapping out your future retirement.

This is an opportunity to become empowered to change your financial position and make informed choices.

Focus on investment opportunities that align with your financial goals and provide a secure future.

Here are some key investment considerations:

Retirement Savings

If you haven't started saving specifically for retirement, it's important to begin as soon as possible. Explore retirement savings options such as a retirement annuity, which offers tax deductions based on your contributions. If you're already saving, review your savings to ensure they will be sufficient for your retirement needs.

Growth investments

Assess whether your investments are too conservative. Consider allocating a portion of your portfolio to growth assets, such as stocks or real estate, which can provide inflation-beating returns and preserve the value of your money over the long term – depending on your finances and your appetite for risk.

Emergency fund

Build an emergency fund to cover unexpected expenses or income loss. Aim to have at least six months' worth of expenses saved. Additionally, consider budgeting for property maintenance and repairs as you accumulate assets.

Education funding

If you have children approaching tertiary education, start planning and saving for these expenses. Consider tax-free investment plans or fixed-return investments as options to help cover these costs.

Tax planning and capital protection

Explore investment options that offer tax benefits and capital protection. Endowments and other tax-efficient investment vehicles can help reduce your tax bill while protecting your capital.

Financial independence

Aim for financial independence, regardless of your relationship status. Invest independently and seek professional advice to ensure you have a sound financial plan in place. It’s key not to give up, but rather take charge of your financial status.

And lastly, if you thought your 60s marked the end of investing, think again. Kiru Padayachee, Business Development Manager at Glacier by Sanlam, discusses prime investment opportunities in your 60s.

Consult with a qualified financial professional

to provide valuable guidance tailored to your specific circumstances and goals.

You don't have to be a financial expert. You just need to partner with one.

Broaden your financial knowledge by understanding your fund fact sheet – here’s a quick guide.

To be a more confident investor, it's important to build your knowledge about the various aspects of investing, ensuring you understand the basic terms and tenets. If you’re new to investing, you may or may not have heard of a “fund fact sheet”.

Simply put, it's an overview of a fund – including the fund's investment objective, risk level, costs involved, past performance, and asset details. If you’re already investing, you’ll know the fact sheet is a convenient tool to help investors learn more about a fund. Understanding your fund fact sheet is crucial for making informed investment decisions. It allows you to compare different funds and make like-for-like comparisons.

By fully comprehending the fact sheet, you can actively participate in investment decisions with your financial adviser. It also enables you to ask the right questions and make fair comparisons with other available funds.

Intimidated by your fund fact sheet? Don't be. If you want to broaden your financial education and take advantage of investment opportunities, this guide will show you how simple it is.

Fund objective

This is what the fund manager has set out to do by investing in a range of assets.

It includes the fund's target benchmark, investment strategy, ideal investment timeframe, underlying assets, performance metrics, and whether it has local or offshore exposure.

You invest with the goal of seeing your money grow, but some funds aim to do this more aggressively than others. For example, if you are a more cautious investor – perhaps you’re closer to retirement – you’d be looking for a consistent, low-risk return, with a focus on capital preservation and minimal withdrawals.

As an investment platform, Glacier offers solutions that cater to the entire investing life cycle, whether pre-retirement, post-retirement, investing for your child’s education, tax-free accounts, or investing for specific goals, for example, saving for a holiday in five years’ time.

Risk profile

Each fund has a risk profile that indicates its level of exposure to growth assets such as equities and property. It helps investors determine whether the fund matches their risk “appetite”. Higher-risk funds offer the potential for higher returns – but also come with higher volatility. Lower-risk funds focus on capital preservation and providing income.

The role of a financial adviser is very important here because they can profile you by asking a set of questions to gauge what your appetite for risk is, and that’ll tell you whether a fund is suitable for you.

Benchmark

A fund's benchmark is the metric it seeks to outperform. It can be a market index, an inflation-targeted benchmark, a peer average, or a custom benchmark created by the fund manager.

The fund manager would come up with a unique set of measures that the fund would be measured against.

An inflation-targeted benchmark would look something like this: ‘CPI (consumer price index) + 5%’. This means the fund aims to outperform inflation by 5%.

Total investment charge

This comprises two costs associated with maintaining the fund. The total expense ratio (TER) covers the day-to-day fund management fees, administration fees, custodial fees, and potential performance fees.

Transaction costs include the fees involved in buying the underlying assets. Glacier’s investment platform gives you access to leading local and international investment funds to suit your portfolio, including those suited to the cost-conscious investor, all in one place.

Cumulative and annualised performance

These figures represent the fund's returns over a specific period. Cumulative performance is the total return since the fund's inception, while annualised performance shows the average return per year over a given time-period.

Annualised returns over one, three, and five years are typically indicative of the fund's long-term average returns. Some fact sheets may also include rolling returns, which show the fund's performance relative to the market over a specified period.

Understanding these key features empowers you to analyse a fund's fact sheet, ask your financial advisor more specific questions and make more informed investment decisions.

If you need additional information or insights about a fund, your financial adviser can reach out to the Glacier research team for assistance.

If you want more detailed information

to help you understand your

fund fact sheet, download the free

infographic below.

A partnership with a financial adviser is worth investing in – here’s why.

Once you’ve selected a financial professional to assist you, it’s highly beneficial to meet them. Whether on the phone, virtually, or in person, hearing someone's voice and seeing them face-to-face allows you to build a trusting relationship.

The most successful adviser-investor partnerships are based on trust and a strong connection. "They are less transactional and more relational, and stand the greatest chance of a positive outcome," says Neal Sinclair, a Business Development Manager at Glacier by Sanlam. When meeting with your adviser, make sure you come prepared with the right topics and questions. Not only will it help the conversation flow, but it will get you started on gaining a better understanding of your financial options.

Here is a checklist to consider:

Ensure your will is up to date

A lot can happen in a year. Life changes such as marriage, divorce, death, or birth may require updates to your will and estate planning.

It’s important to discuss any changes in your employment and beneficiary nominations to ensure your intentions are conveyed correctly. Any lifestyle changes may be significant and could impact your risk cover, so be sure to give your adviser a breakdown of recent events.

Evaluate tax efficiency in your financial plan

Regularly ask your financial adviser whether your current plan is as tax-efficient as possible. Consider the structures through which your capital or income is stored or transferred and explore any tax implications related to offshore assets.

Review your portfolio based on your risk appetite

“If you’ve fallen out of your appetite for risk, it’s important to discuss this with your financial adviser so you can manage this appropriately,” says Neal.

You may want less or more risk at certain times and it’s important to be transparent. Assess whether your portfolio aligns with your current risk tolerance. If market performance has affected your goals, share your concerns to make the necessary adjustments.

Access the best investment opportunities

Inquire about the tools and resources your adviser uses to provide you with a wide range of investment options at a reasonable cost.

Consider platforms like Glacier by Sanlam, which offers a comprehensive range of investment solutions and the ability to customise portfolios based on your needs. Glacier’s investment platform facilitates the opportunity to access the widest range of funds and solutions in SA, and to move your investments around as your needs change – without incurring extra cost.

This kind of flexibility matters in your financial planning, so if you're not on Glacier's investment platform, it’s worth asking your adviser why.

Seek peace of mind

In the information age, it's crucial to navigate the overwhelming amount of financial content and distinguish between reliable and misleading information.

Use your meeting with your adviser to discuss any concerns or confusing concepts you come across. Your adviser will provide context and advice that is specific to your financial situation.

“As an investor, if you are doing your own research and come across a story or opinion that alarms you, or you’re unclear about a concept, print the article, take it with you to your meeting and share that it’s got you thinking. Ask your adviser to explain it to you,” suggests Neal.

Remember, building a strong relationship with your financial adviser takes time and trust. By actively engaging in discussions and asking the right questions, you can ensure that your financial plan stays updated and aligned with your goals and circumstances.

The best way your adviser can help you manage your money optimally is through regular financial reviews, to ensure your plan is up to date – and ensure it meets your ever-changing needs.

Take this checklist when meeting with

your financial adviser.

It’s more important now than ever before to ensure your investments are safe and dealt with by a reputable organisation – here’s how you can safeguard yourself.

The recent economic climate has been characterised by various challenges and uncertainties – from the war in Ukraine, to escalating inflation and the widescale cost of living crisis that has been experienced the world over.

It’s hard to imagine “playing around” with your hard-earned money, but securing your financial future is more vital now than ever.

Investments that have been used for savings purposes have gone through a lot of volatility over the recent past, and it’s understandable if you’re wondering if your investments are safe in this current environment.

You may also wonder if certain investment platforms your financial adviser uses to invest your money are safe.

Glacier by Sanlam, as a linked investment service provider (LISP), is one such investment platform. Read on to learn about the different aspects of security and how it affects your investments.

Research and due diligence

It's important to research and understand the investment platform or financial institution you are considering. Look for information about their reputation, track record, and regulatory compliance.

Check if they are registered with the appropriate financial authorities and if their licenses are up to date.

External auditors and compliance framework

Look for investment platforms or financial institutions that have robust governance, risk management, and compliance frameworks in place. External auditors can provide an additional level of assurance regarding the accuracy and integrity of financial information.

Financial advisor credentials

If you work with a financial advisor, make sure they are licensed and registered with the appropriate regulatory authorities. You can verify their credentials and check if any disciplinary actions have been taken against them.

Stay informed

Keep yourself updated on the performance of your investments and the market conditions. Regularly review your investment portfolio and consult with your financial advisor to ensure your investments align with your financial goals and risk tolerance.

Lana Paterson, compliance manager at Glacier by Sanlam, says that at the stage of opening an investment, it’s important to pay close attention to the application form that you, as the investor, complete. “The terms and conditions of the application form must disclose to you [the customer], in whose name the assets are registered. This is prescribed by law,” she says.

The LISP, as an administrative financial services provider, (referred to as the investment platform throughout this article) must be registered with the Financial Sector Conduct Authority (FSCA), which is a regulatory body for financial institutions.

If you’re unsure whether the company is registered with the FSCA, you can check this on the regulator’s website, which stores an approved list of nominee companies.

The benefit of investing through an investment platform is that you don’t have to go to each management company (ManCo) even if you have your money invested with different ManCos.

You can access them all through the investment platform. Glacier’s investment platform offers a simple way to access leading local and international investment funds, all in one place, with the flexibility to mix and match your fund selection with ease.

Remember that investing always carries some degree of risk, and it's important to carefully consider your own financial situation, risk tolerance, and investment goals before making any investment decisions.

If you have specific concerns or questions about your investments, it's best to consult with a qualified financial professional who can provide personalised advice based on your individual circumstances.

Be sure to consult with a financial adviser before you take any action regarding your savings and investments.

Glacier Financial Solutions (Pty) Ltd. is a Licensed Financial Services Provider. Sanlam Life Insurance Limited is a Licensed Life Insurer, authorised Financial Services Provider and a registered

Credit Provider (NCRCP43)